The all-in-one platform

for financial advisers

The all-in-one platform for financial advisers

The all-in-one platform for financial advisers

AI-powered practice management available now - with integrated custody and execution launching soon.

Get Started For Free

Save Time & Grow AUM

Save Time &

Grow AUM

Save Time & Grow AUM

Free

AI Practice Management

AI Practice

Management

AI meeting notes, CRM, and portfolio aggregation all in one free module.

Learn more

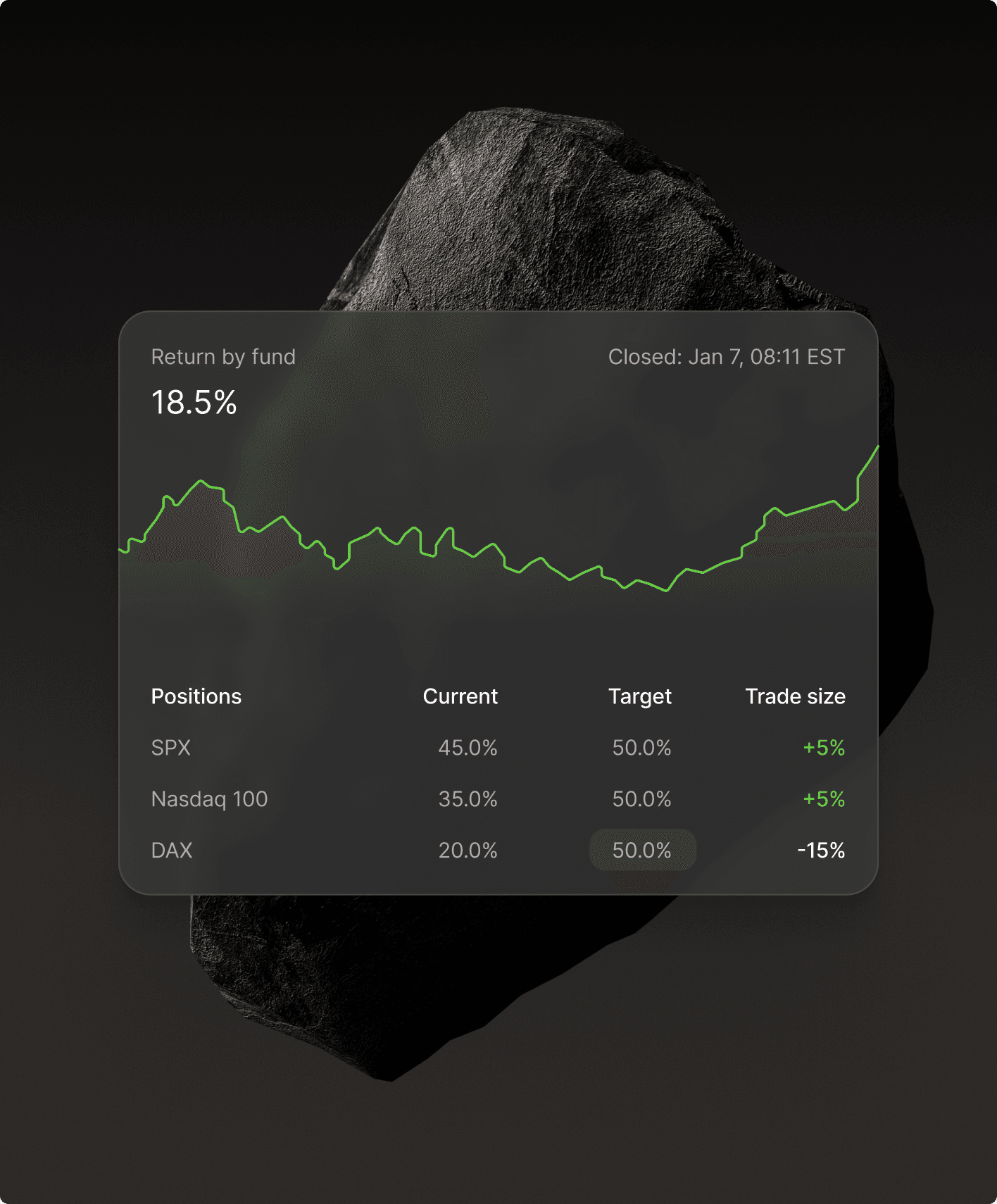

Coming Soon

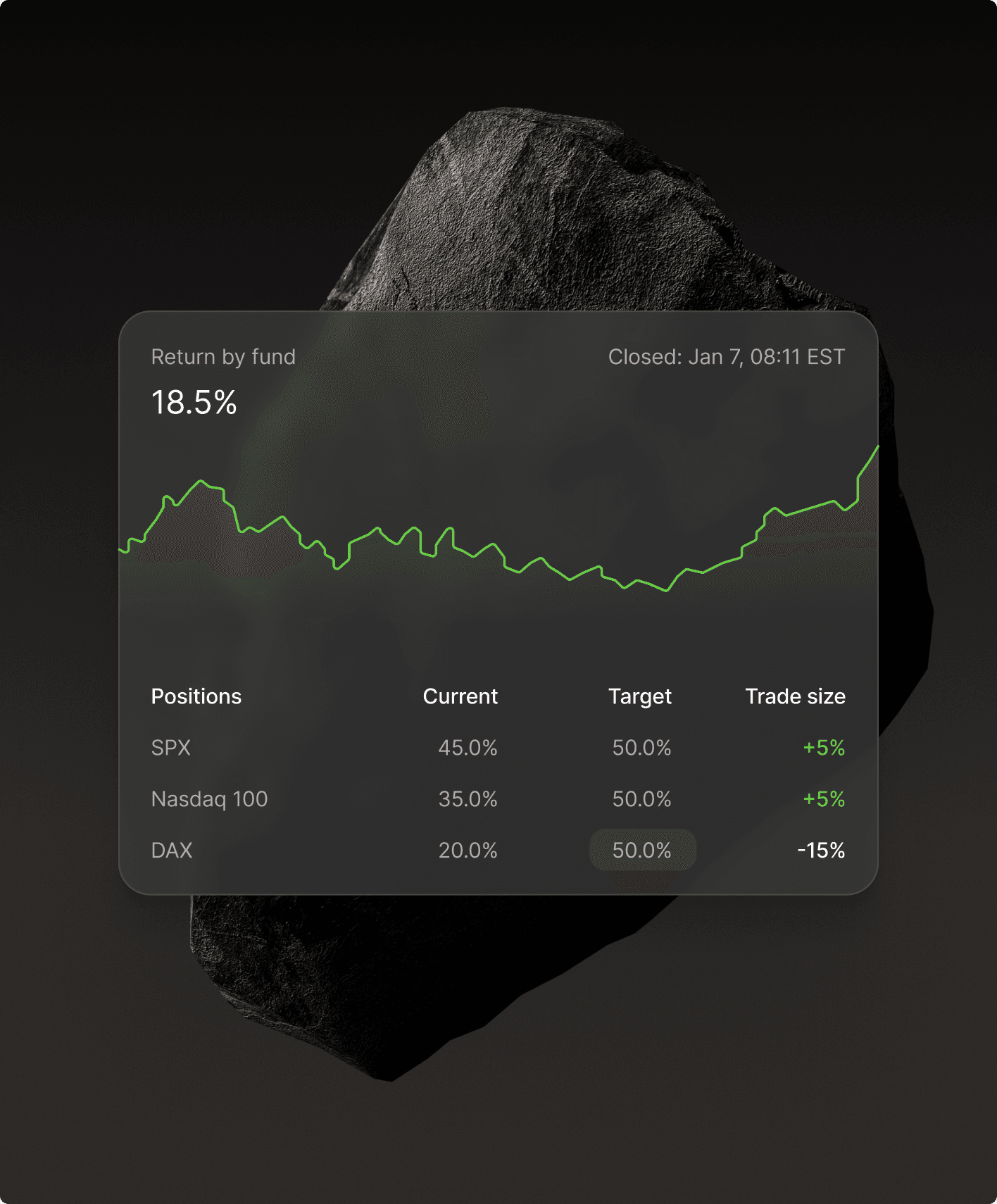

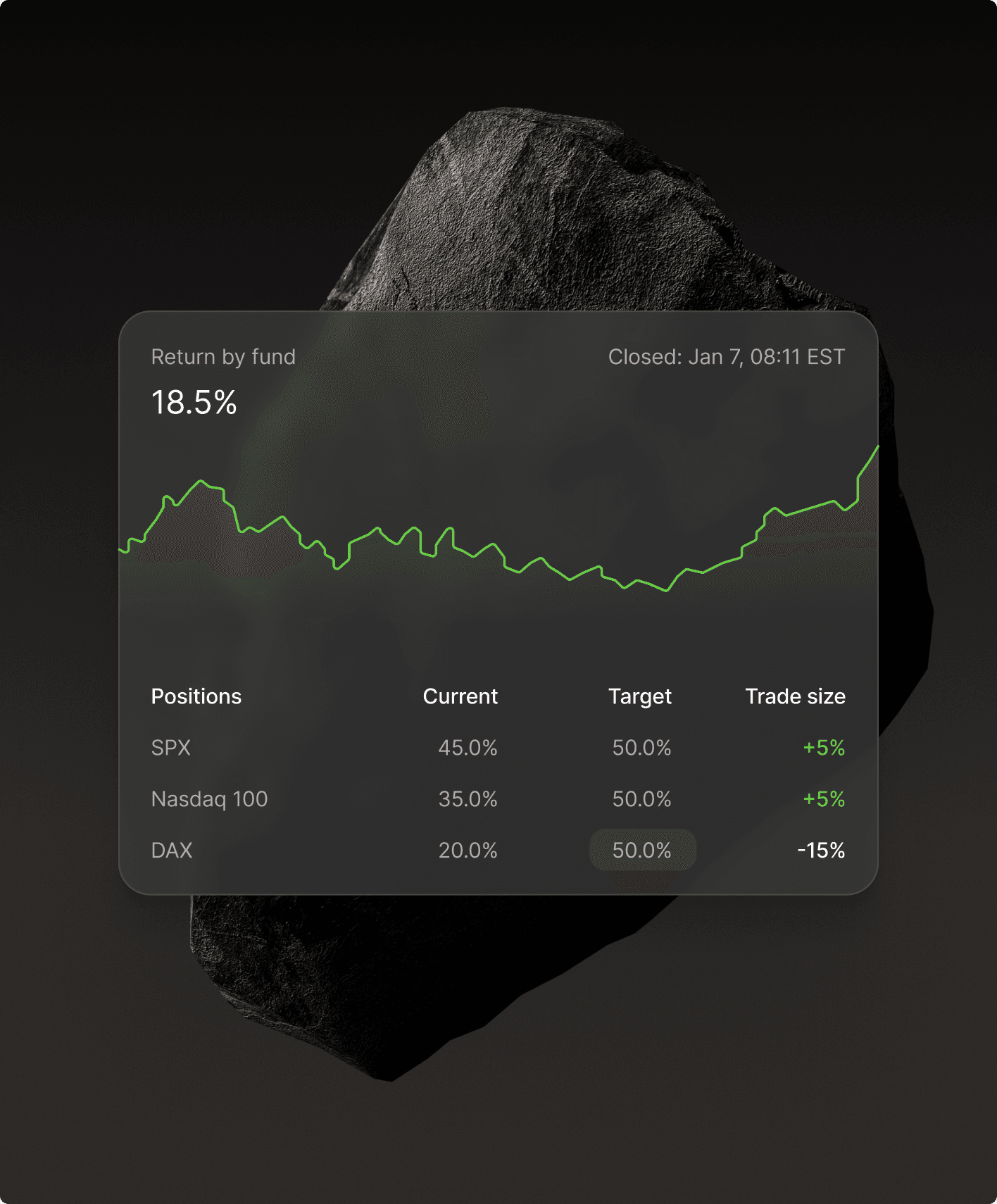

Execution & Custody

Execution &

Custody

Trade, rebalance, and custody - all in one place. With instant account opening.

Learn more

The platform that scales your firm

Independent firms

Spend less time on admin and more time delivering advice that matters.

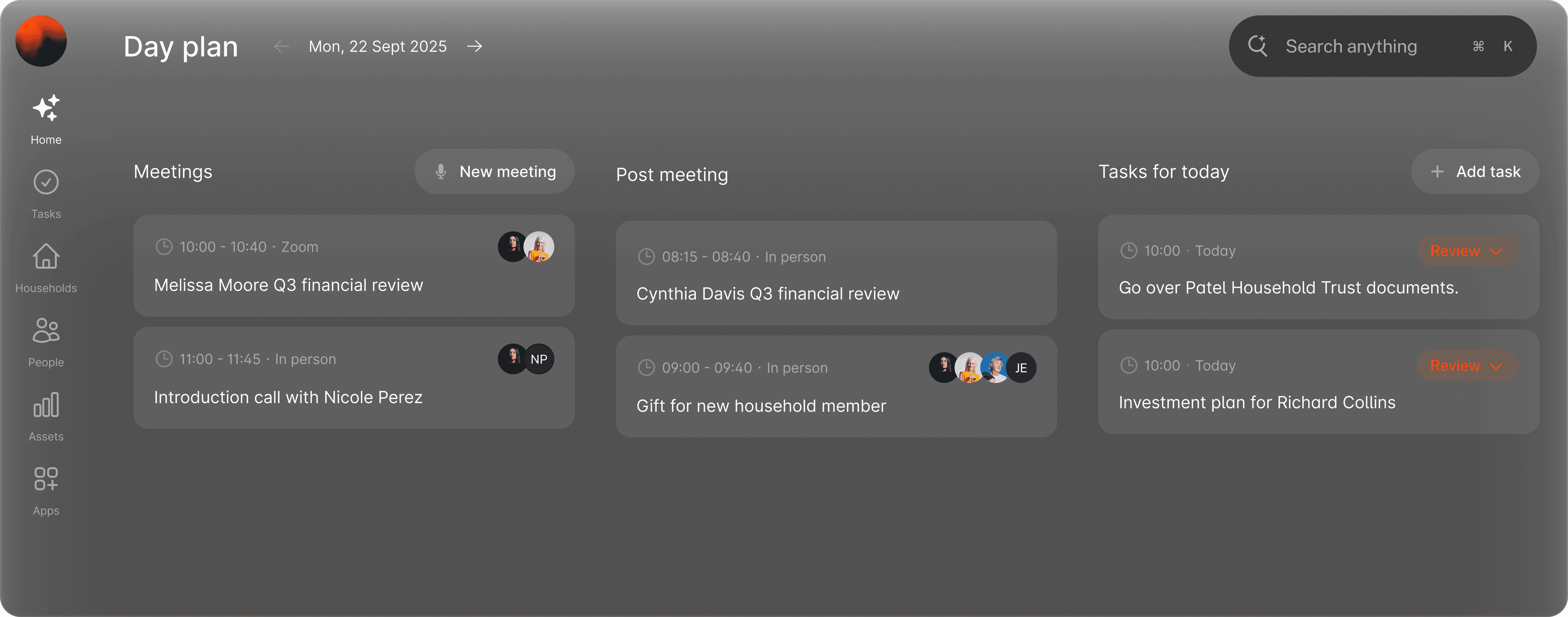

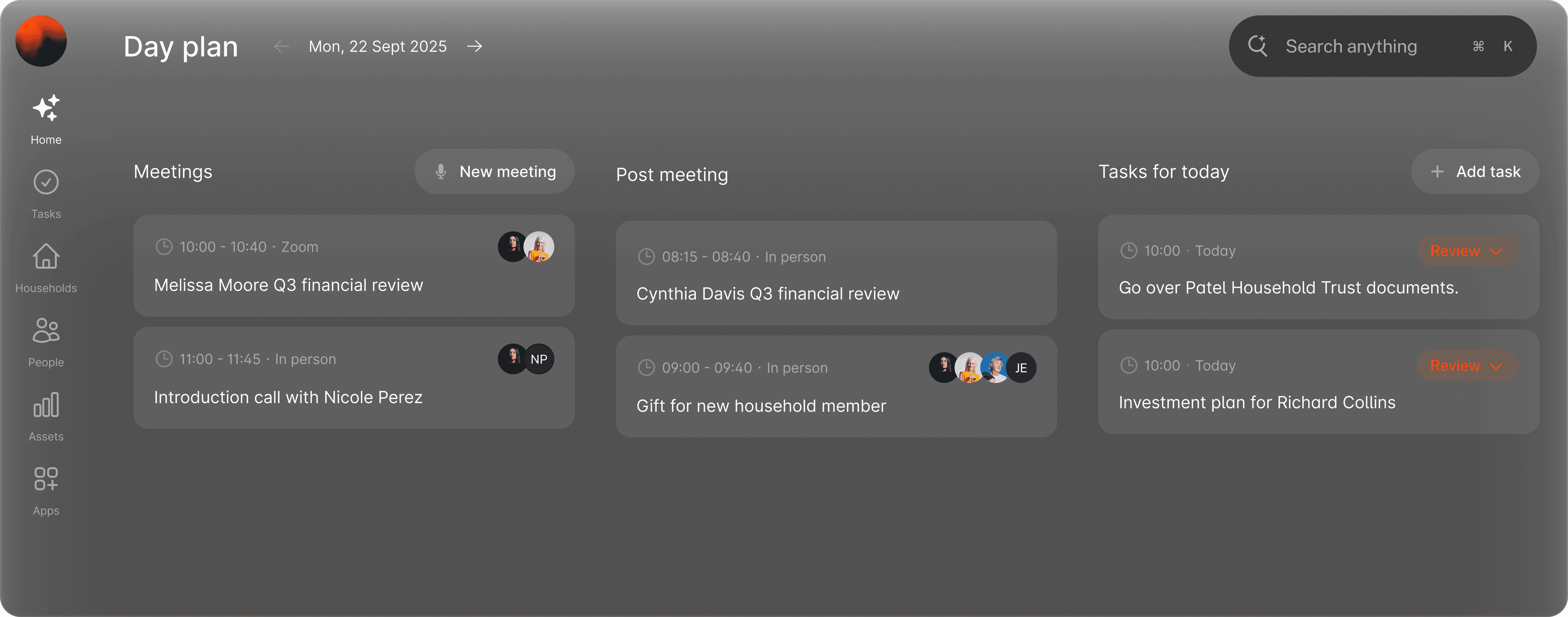

Day plan

Kanban view of meetings, tasks, and client communications.

AI search

AI Meeting Summaries

Document Digitisation

Suitability Report

Portfolio aggregation

Client-Ready Emails in Your Voice

Independent firms

Spend less time on admin and more time delivering advice that matters.

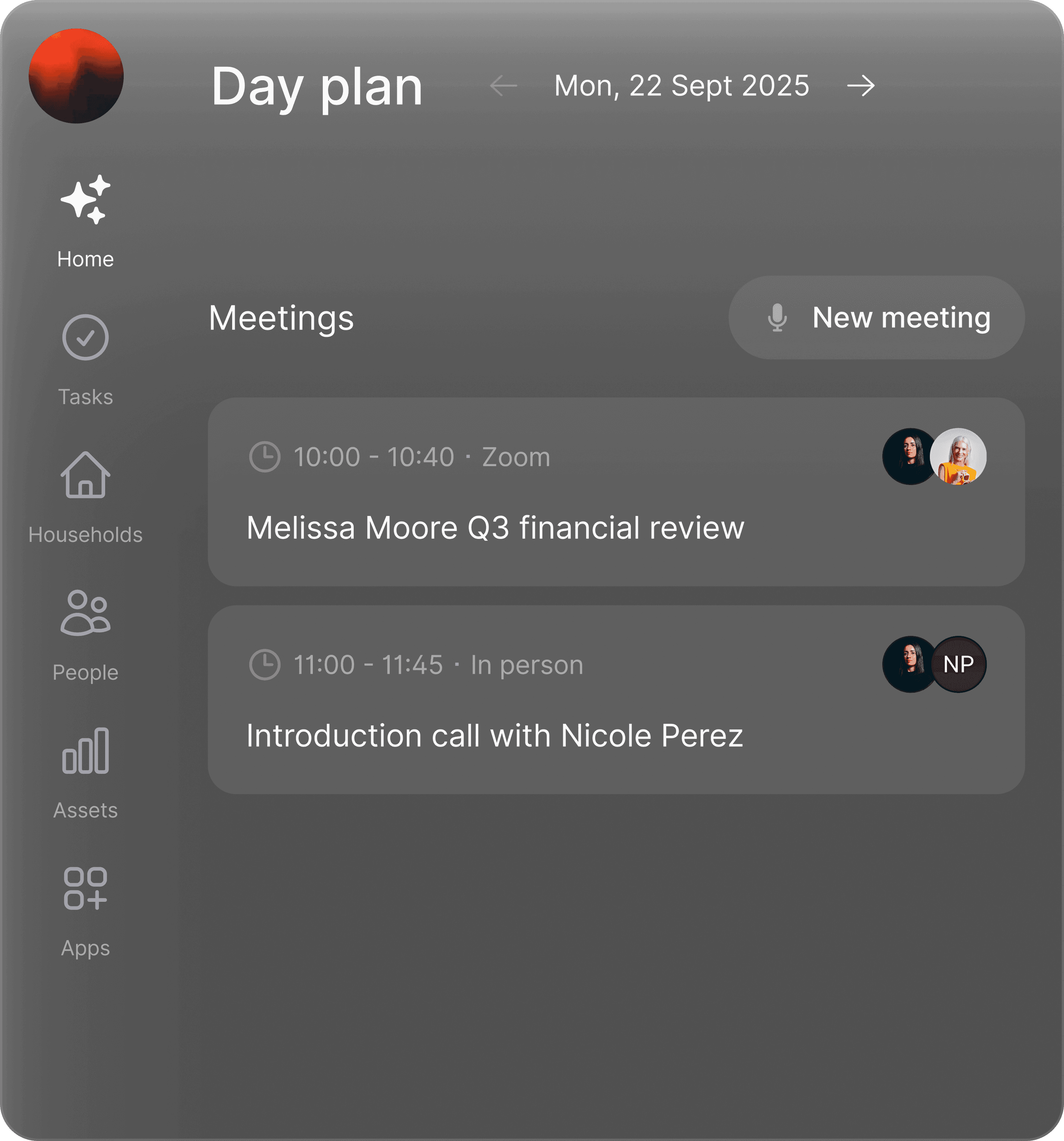

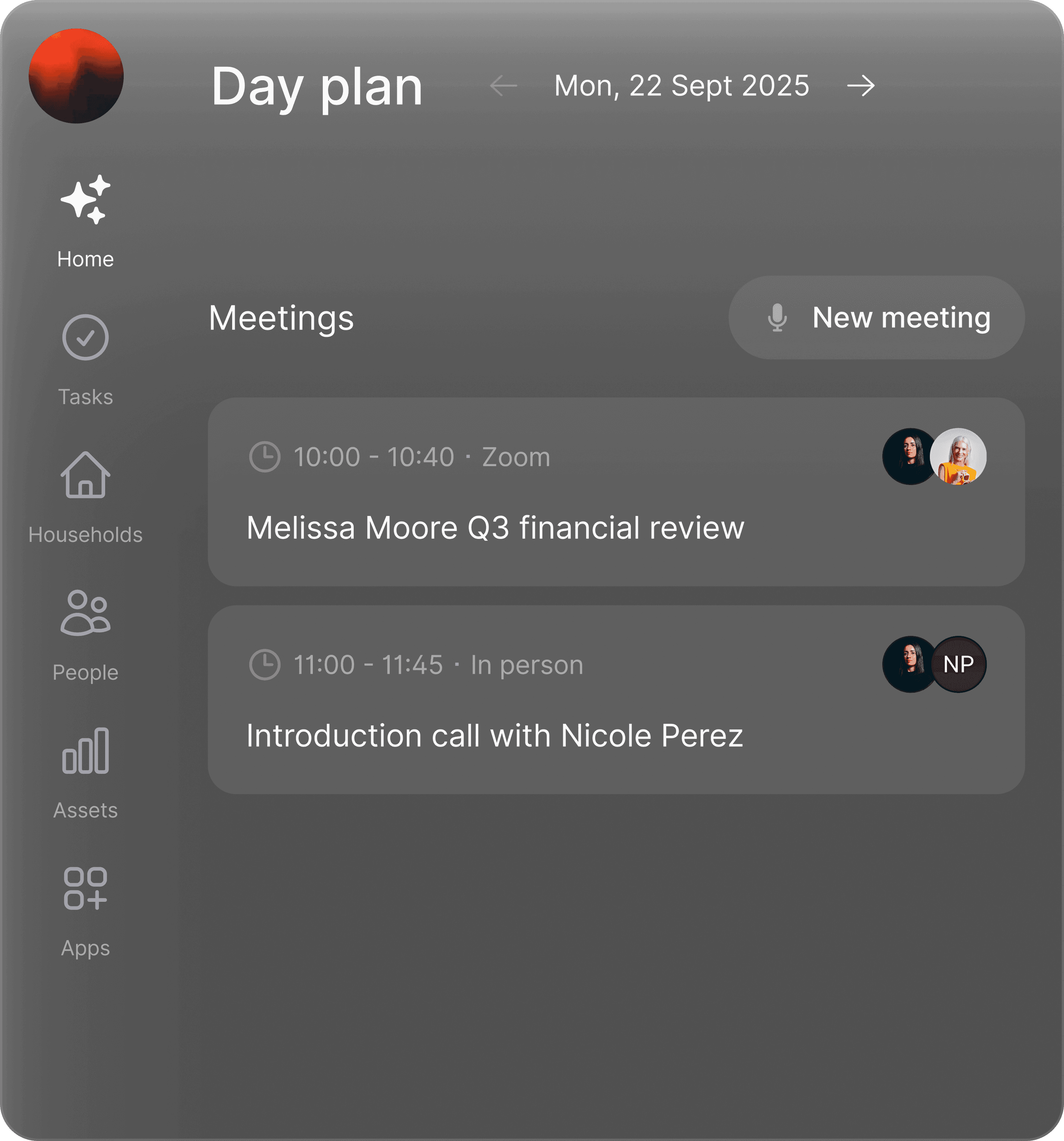

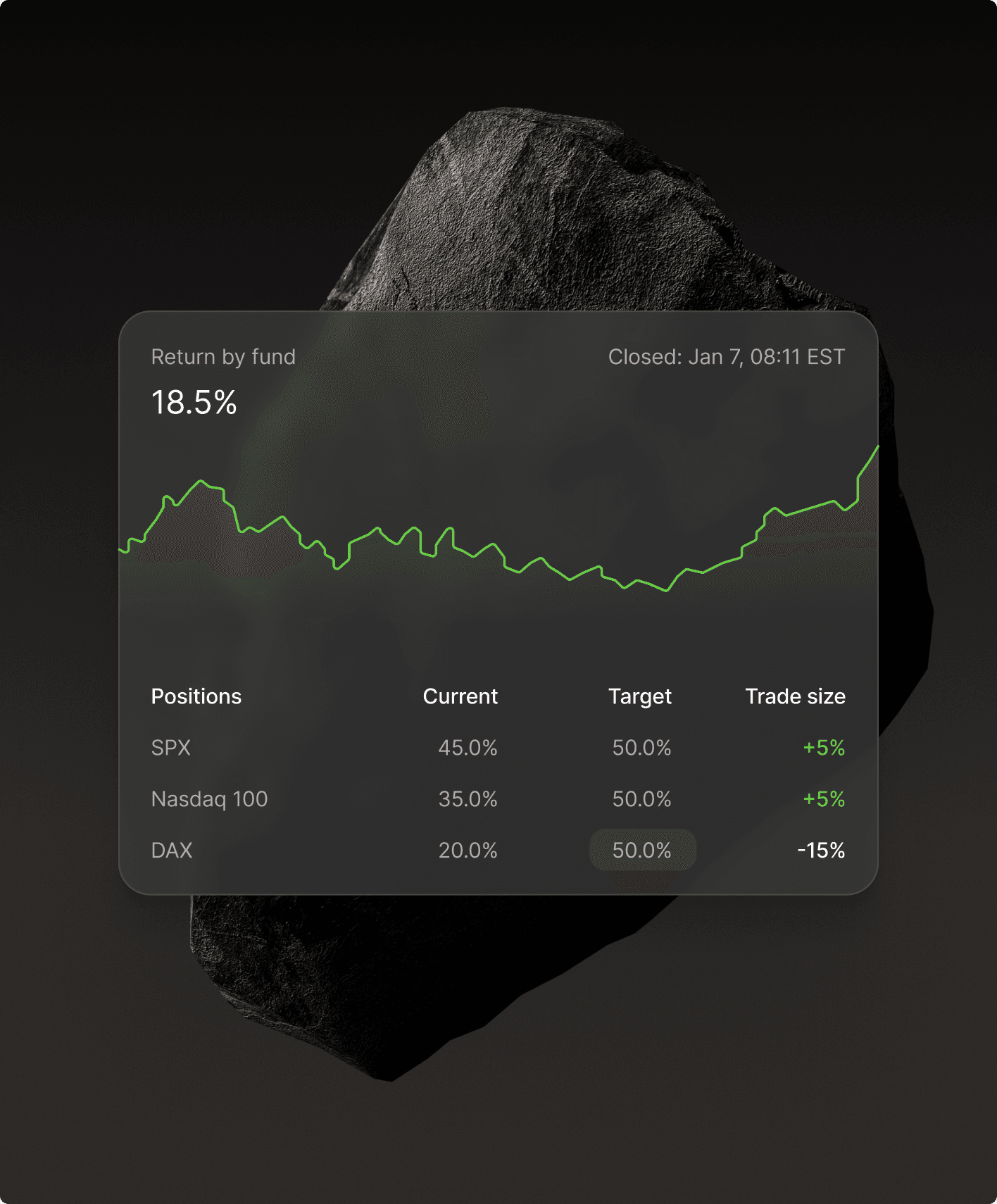

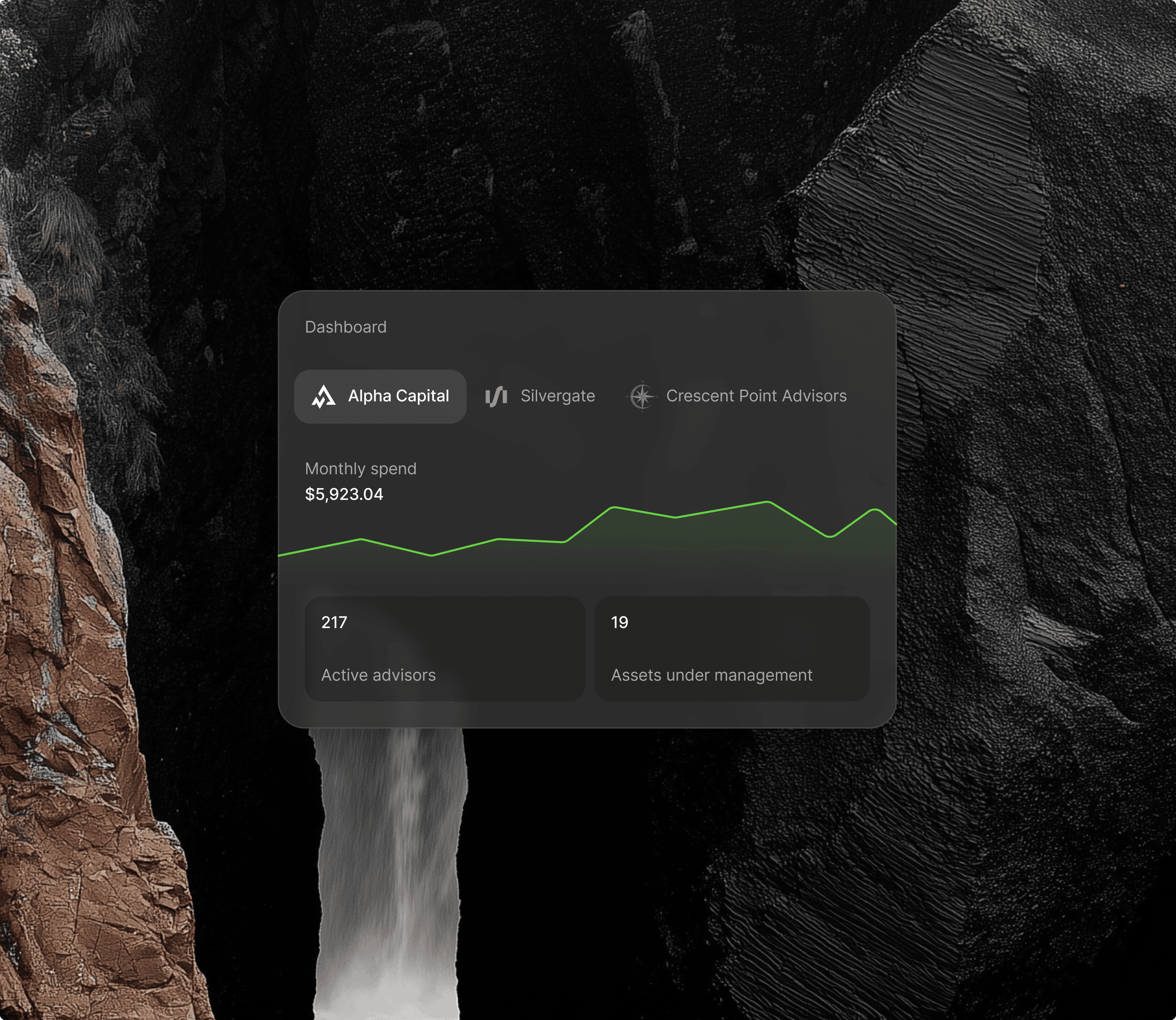

Day plan

Your command centre for the day. A Kanban-style view that brings together meetings, tasks, and client communications so you always know what needs attention.

AI search

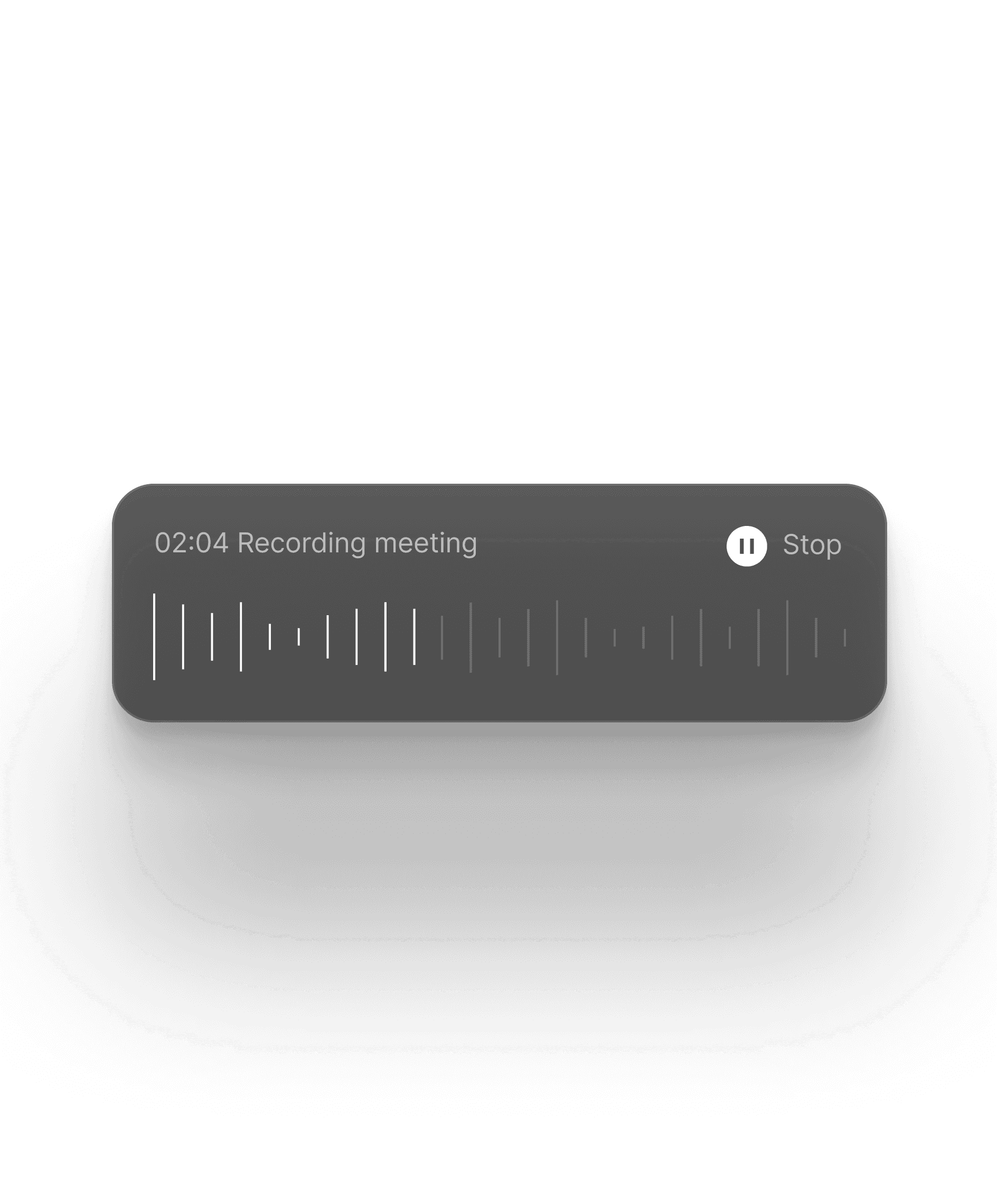

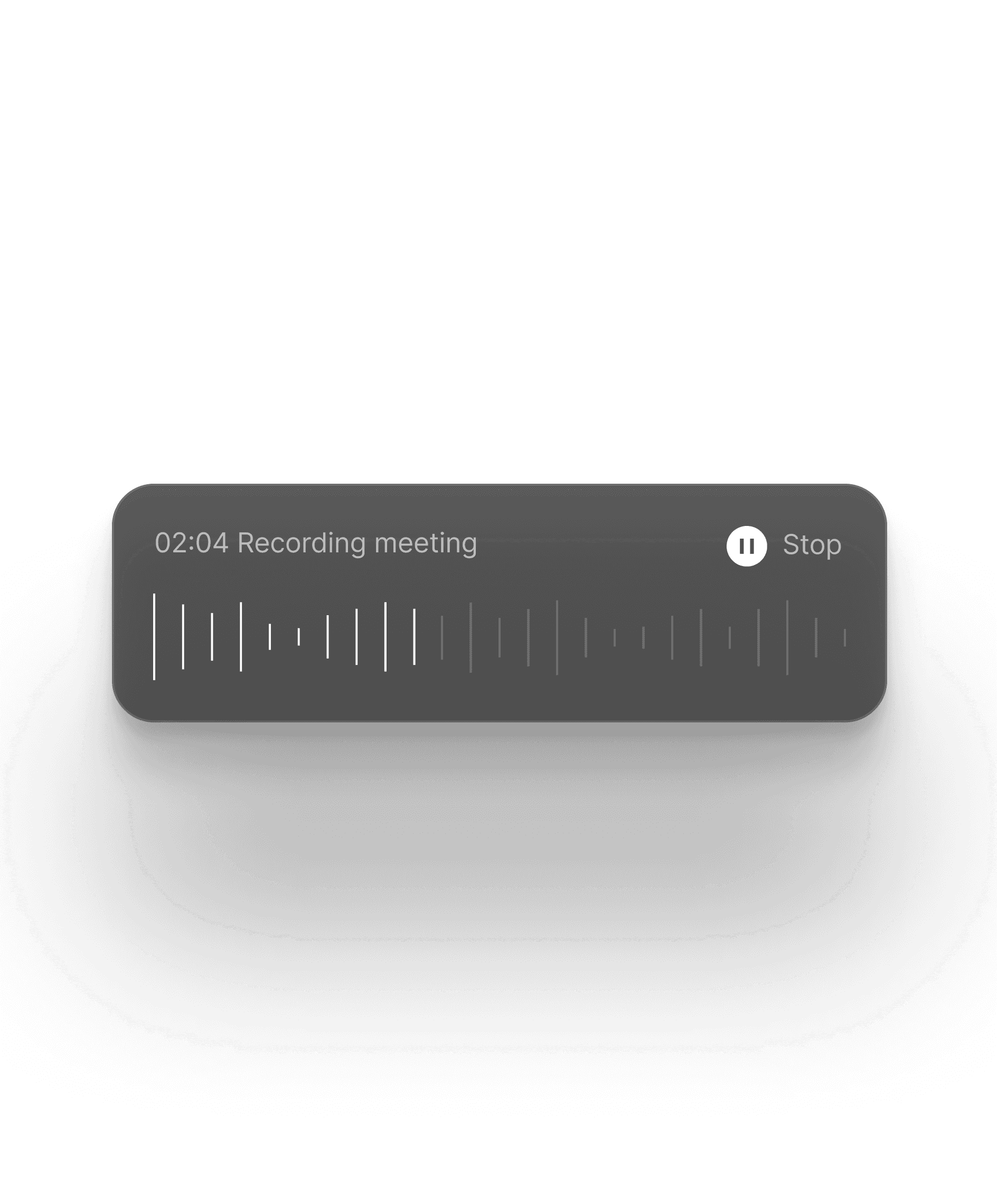

AI Meeting Assistant

Document Digitization

Suitability Report

Portfolio aggregation

Client-Ready Emails in Your Voice

Independent firms

Spend less time on admin and more time delivering advice that matters.

Day plan

Your command centre for the day. A Kanban-style view that brings together meetings, tasks, and client communications so you always know what needs attention.

AI search

AI Meeting Assistant

Document Digitization

Suitability Report

Portfolio aggregation

Client-Ready Emails in Your Voice

Independent firms

Spend less time on admin and more time delivering advice that matters.

Day plan

Your command centre for the day. A Kanban-style view that brings together meetings, tasks, and client communications so you always know what needs attention.

AI search

AI Meeting Assistant

Document Digitization

Suitability Report

Portfolio aggregation

Client-Ready Emails in Your Voice

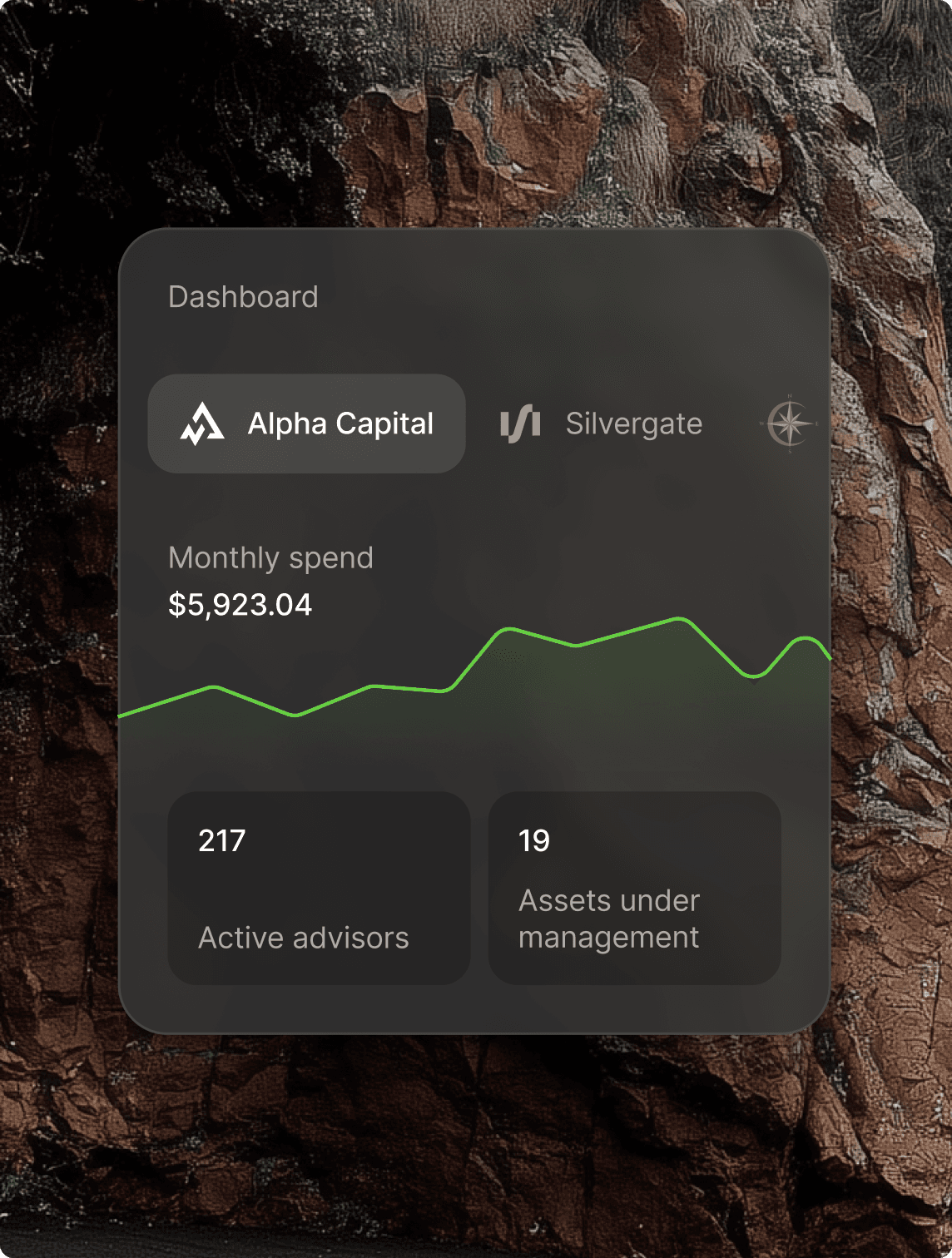

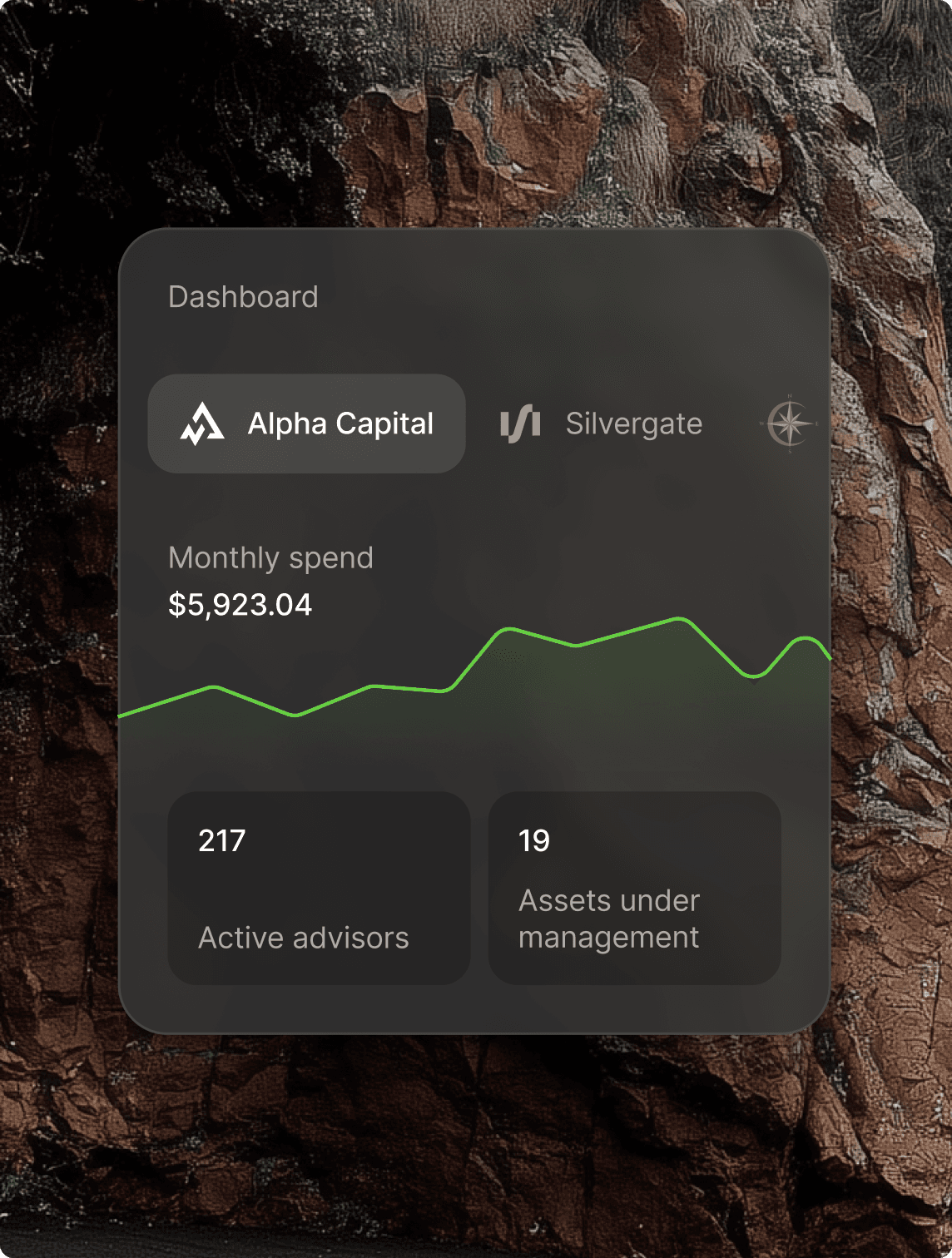

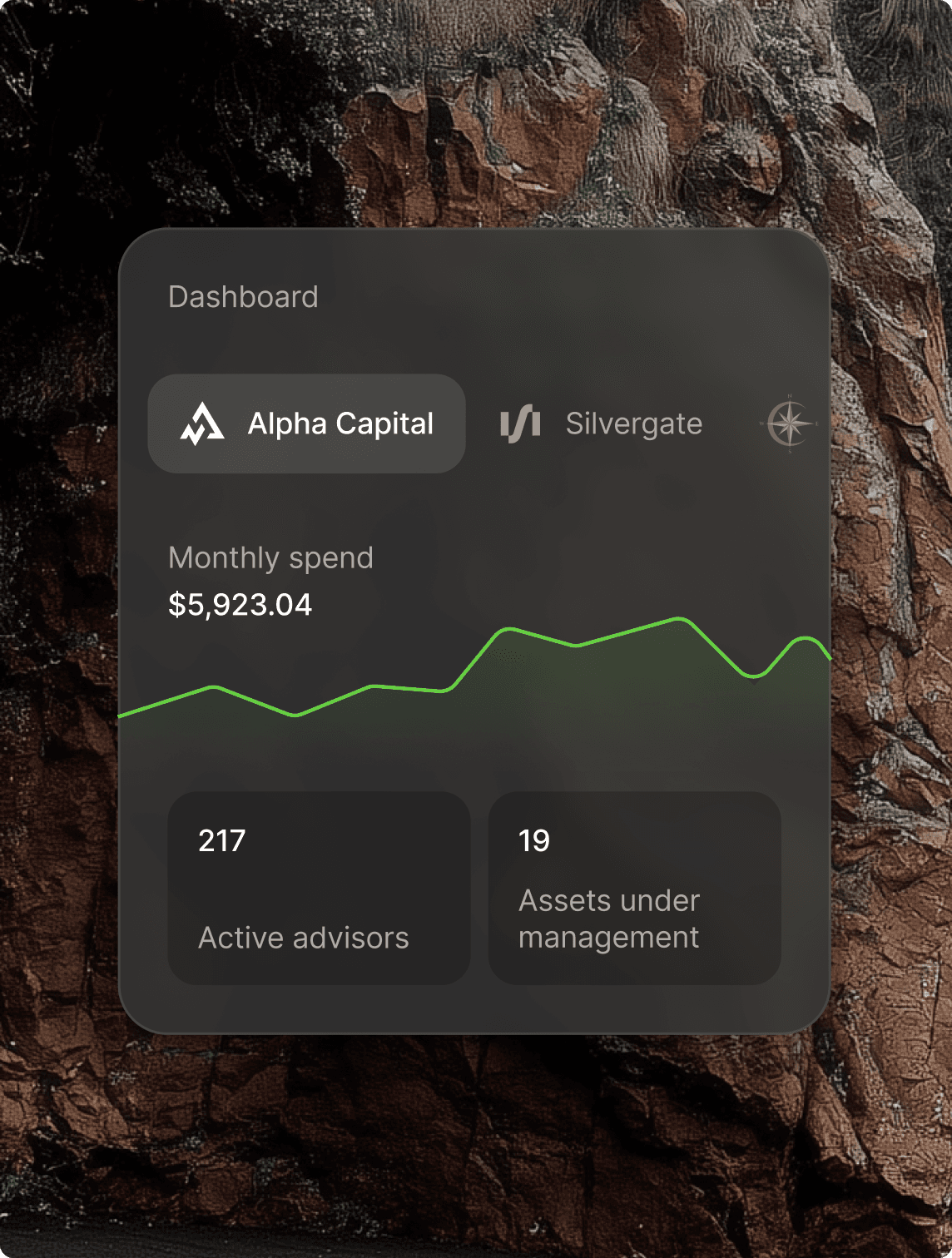

Unlock rapid growth

Unlock rapid growth

Unlock rapid growth

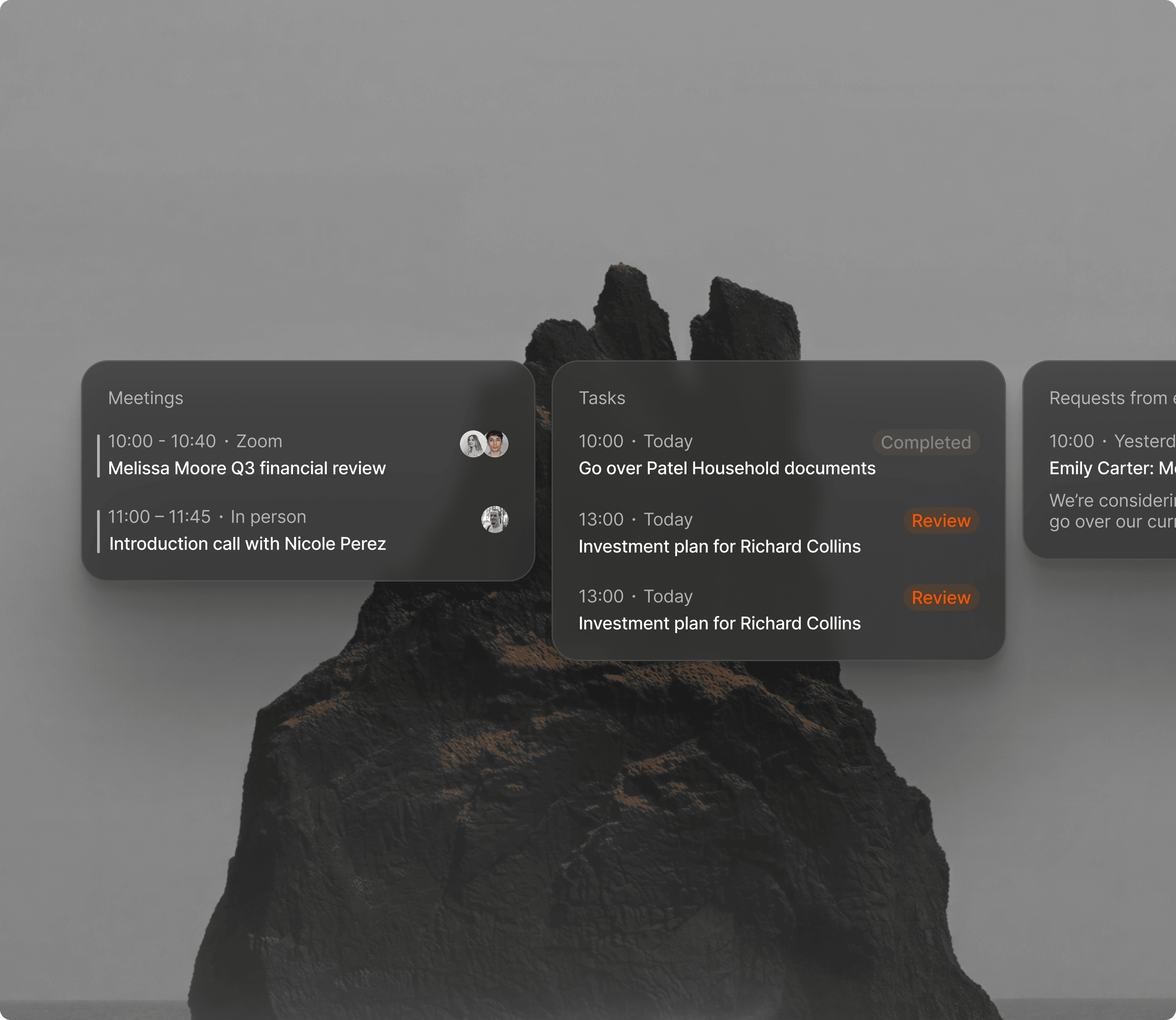

Consolidators

Unify firms, data, and controls to scale faster—without operational drag.

Multi-firm oversight

Manage multiple firms under one organisation with consolidated reporting, controls, and visibility.

Rapid onboarding

Document digitisation

Data segregation

Role-based access

Audit trails

Everything for Independent Firms and more

Consolidators

Unify firms, data, and controls to scale faster—without operational drag.

Multi-firm oversight

Manage multiple firms under one organisation with consolidated reporting, controls, and visibility.

Rapid onboarding

Document digitisation

Data segregation

Role-based access

Audit trails

Everything for Independent Firms and more

Consolidators

Unify firms, data, and controls to scale faster—without operational drag.

Multi-firm oversight

Manage multiple firms under one organisation with consolidated reporting, controls, and visibility.

Rapid onboarding

Document digitisation

Data segregation

Role-based access

Audit trails

Everything for Independent Firms and more

Consolidators

Unify firms, data, and controls to scale faster—without operational drag.

Multi-firm oversight

Manage multiple firms under one organisation with consolidated reporting, controls, and visibility.

Rapid onboarding

Document digitisation

Data segregation

Role-based access

Audit trails

Everything for Independent Firms and more

Built for regulated environments

Built to industry standards

FCA authorisation in progress. SOC2 audit underway.

Security by default

Two-factor authentication for every user.

Zero data leakage

Built in-house. Hosted entirely on Obsidian's infrastructure.

Obsidian Securities Limited is not yet authorised by the Financial Conduct Authority.

Prior to becoming authorised no information regarding the future provision of custody and execution services is intended as an invitation or inducement to apply for these services, nor does it constitute financial advice.

Powered by

Obsidian Securities Limited is not yet authorised by the Financial Conduct Authority. Prior to becoming authorised no information regarding the future provision of custody and execution services is intended as an invitation or inducement to apply for these services, nor does it constitute financial advice

Powered by

Obsidian Securities Limited is not yet authorised by the Financial Conduct Authority. Prior to becoming authorised no information regarding the future provision of custody and execution services is intended as an invitation or inducement to apply for these services, nor does it constitute financial advice

Powered by

Obsidian Securities Limited is not yet authorised by the Financial Conduct Authority. Prior to becoming authorised no information regarding the future provision of custody and execution services is intended as an invitation or inducement to apply for these services, nor does it constitute financial advice

Powered by